Have you ever felt overwhelmed by the world of finance? It’s a sea of numbers, graphs, and jargon that can seem daunting even to the most seasoned business professional. But what if I told you that mastering a few key financial formulas could unlock a world of understanding, empower you to make sound financial decisions, and even give you a competitive edge in your career? This is precisely the aim of FIN 320 Project Two, which introduces you to a set of fundamental formulas that underpin the world of finance. Let’s embark on this journey together, demystifying these seemingly complex formulas and revealing their invaluable practical applications.

Image: www.coursehero.com

The importance of understanding financial formulas goes beyond mere academic pursuit. These tools provide a framework for analyzing financial performance, evaluating investment opportunities, and making strategic decisions that impact our own personal lives as well as the trajectory of businesses and economies. Whether you’re an aspiring financial analyst, an entrepreneur looking to grow your business, or simply someone who wants to make informed decisions about your finances, mastering these formulas will equip you with the tools to navigate the financial landscape with confidence.

**Delving into the Essentials: Fin 320 Project Two Formulas**

The FIN 320 Project Two introduces a range of essential financial formulas, each serving a unique purpose in understanding and analyzing financial data. Let’s break down each formula, exploring its nuances, applications, and practical significance:

- Net Income: This foundational formula is a cornerstone of financial analysis. It represents the profit earned by a company after accounting for all expenses.

Net Income = Revenue – Expenses

This formula helps us understand a company’s profitability and its ability to generate profits. A healthy net income is a crucial indicator of financial health.

- Earnings Per Share (EPS): This vital metric tells us how much profit a company earns for each outstanding share of stock.

EPS = Net Income / Number of Outstanding Shares

A higher EPS generally indicates a more profitable company and can influence stock value.

- Return on Equity (ROE): This key performance indicator reveals how efficiently a company uses its shareholder’s equity to generate profit.

ROE = Net Income / Shareholder’s Equity

A high ROE suggests that a company is effectively using its resources to generate returns for its investors.

- Debt-to-Equity Ratio: This formula assesses a company’s financial leverage by comparing its total debt to its shareholders’ equity.

Debt-to-Equity Ratio = Total Debt / Shareholder’s Equity

A higher debt-to-equity ratio indicates greater financial risk as the company relies heavily on debt financing.

- Profit Margin: This metric tells us how much profit a company generates for every dollar of revenue.

Profit Margin = Net Income / Revenue

A higher profit margin generally indicates a company’s ability to control costs and efficiently generate profit.

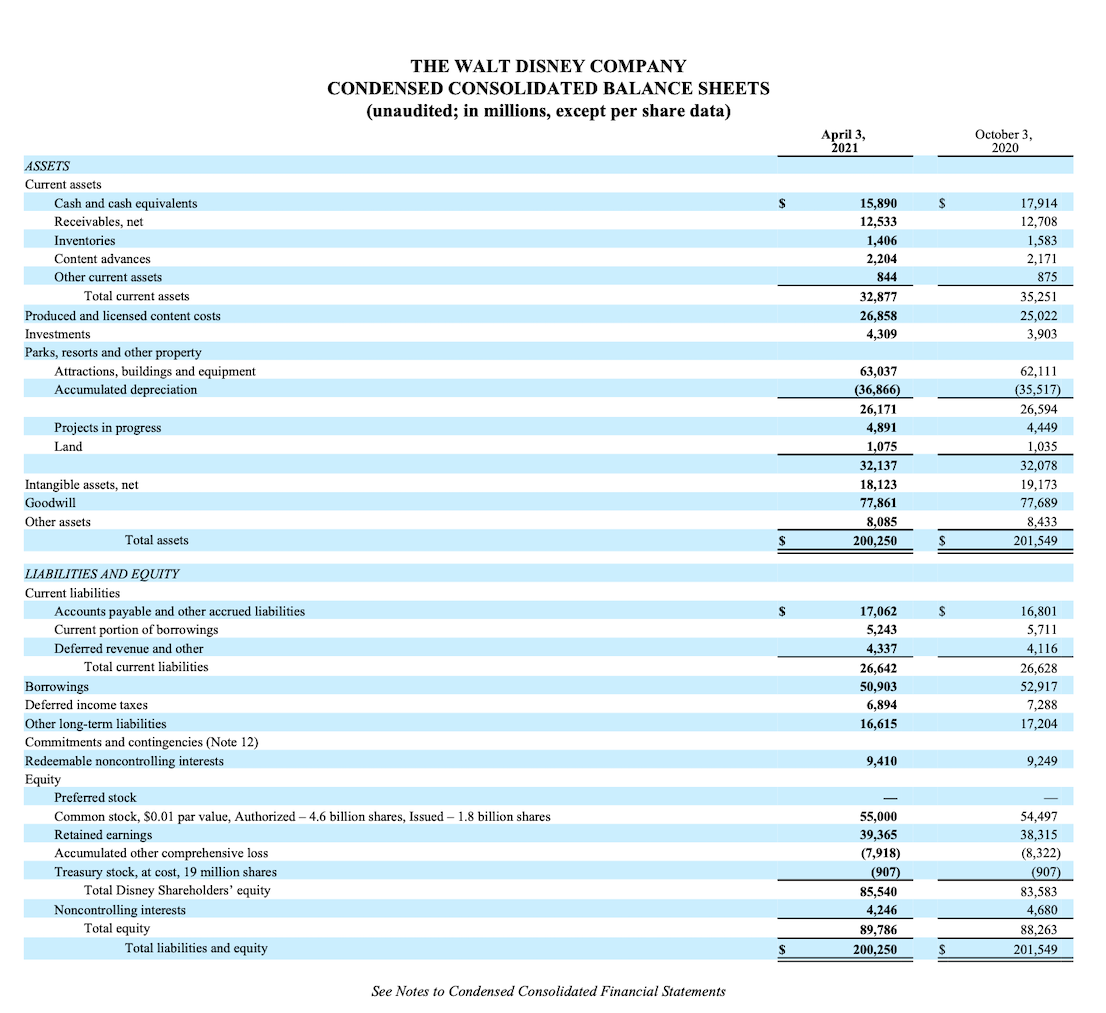

- Current Ratio: This liquidity ratio measures a company’s ability to meet its short-term financial obligations.

Current Ratio = Current Assets / Current Liabilities

A higher current ratio indicates a greater ability to meet short-term obligations, but a very high ratio could suggest inefficient use of assets.

- Quick Ratio: This ratio is a stricter measure of liquidity, excluding inventory from current assets.

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

The quick ratio provides a more conservative assessment of a company’s ability to meet immediate short-term obligations.

- Inventory Turnover Ratio: This ratio quantifies how efficiently a company manages its inventory.

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

A higher inventory turnover ratio typically indicates effective inventory management and potentially lower storage costs.

- Days Sales Outstanding: This metric reveals how long it takes a company to collect payments from its customers.

Days Sales Outstanding = (Average Accounts Receivable / Revenue) * 365

A high DSO suggests potential issues with collecting payments on time and could indicate a risk of bad debts.

- Payables Turnover Ratio: This ratio measures how efficiently a company pays its suppliers.

Payables Turnover Ratio = Cost of Goods Sold / Average Accounts Payable

A high payables turnover ratio might suggest the company is taking advantage of extended payment terms, but could also signal potential supplier relationship issues.

- Return on Assets (ROA): This profitability ratio measures how effectively a company uses its assets to generate earnings.

ROA = Net Income / Total Assets

A high ROA indicates that a company is generating a good return on its investments in assets.

- Price-to-Earnings Ratio (P/E Ratio): This popular valuation metric compares a company’s stock price to its earnings per share.

P/E Ratio = Market Price per Share / Earnings per Share

A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings, potentially indicating a belief in future growth potential.

**Expert Insights & Actionable Tips**

“The beauty of financial formulas lies not just in their calculations, but in their ability to provide valuable insights,” says seasoned finance professional and author, John Smith. “Understanding how these formulas work and their implications allows you to make informed decisions, whether you’re investing in stocks, managing a budget, or analyzing financial performance.”

Smith emphasizes that while these formulas are powerful tools, they are not a substitute for critical thinking and a comprehensive understanding of the company or financial situation. “It’s crucial to consider the context surrounding these numbers, and to analyze the story they tell beyond the pure calculations,” he advises.

Image: www.chegg.com

Fin 320 Project Two Financial Formulas

**Conclusion**

Mastering the financial formulas introduced in FIN 320 Project Two equips you with the foundation to navigate the world of finance with confidence. These tools empower you to analyze performance, evaluate investments, and make informed decisions that can impact your personal finances, business strategies, and even the global economy.

Don’t stop at just memorizing the formulas. Embrace them as tools for understanding, interpretation, and insight. Dive deeper, explore real-world applications, and utilize these powerful formulas to unlock the full potential of your financial knowledge.