The whirring of a fax machine, the gentle clatter of a keyboard, and the nervous anticipation of a waiting line – these are just some of the memories associated with depositing a check. But what if we told you that behind the scenes, a hidden network of numbers silently orchestrates these transactions, ensuring your money reaches its destination safely and swiftly? These are routing numbers, and they play a crucial role in our financial system. Today, we delve into the world of routing numbers, focusing specifically on the unique set assigned to Federal Reserve Banks.

Image: www.scribd.com

For many of us, the mechanics of banking seem like a mysterious process, shrouded in financial jargon and bureaucratic obscurity. Yet, understanding routing numbers sheds light on the intricate workings of our national banking system, a system that relies heavily on the Federal Reserve. Let’s unravel the coded language behind these seemingly mundane numbers and discover their essential role in the American financial landscape.

Understanding Routing Numbers: A Backbone of the Financial System

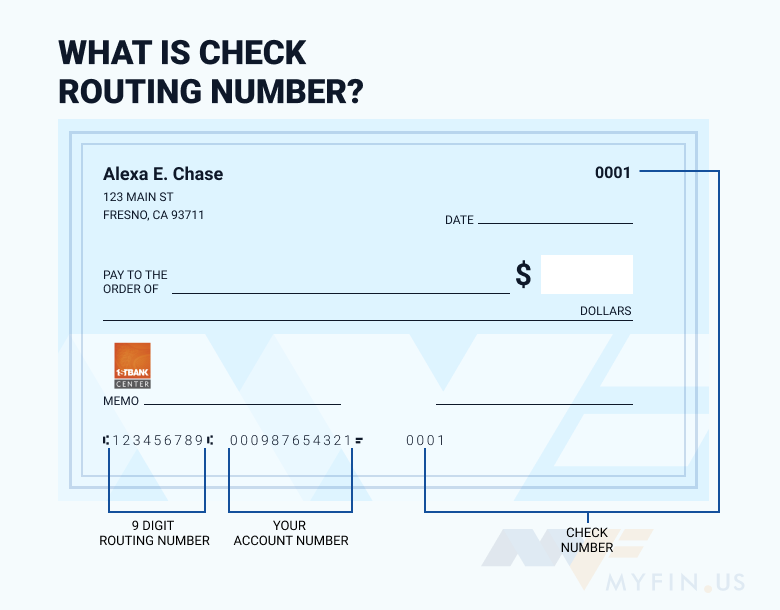

Routing numbers, officially known as ABA (American Bankers Association) Routing Numbers, serve as vital identifiers for financial institutions within the United States. These nine-digit codes act as postal addresses for your money, ensuring swift and accurate transmission between banks. Essentially, when you deposit a check, transfer funds, or pay a bill electronically, your bank’s routing number tells the receiving bank’s network where to send the money.

Imagine the chaotic scenario without these numbers. Every bank would have to rely on unique identifiers, causing a logistical nightmare for the processing of transactions. Routing numbers standardize this process, creating an interconnected system that facilitates smooth financial operations across the nation.

The Role of Federal Reserve Banks in Routing Numbers

The Federal Reserve, the central banking system of the United States, plays a pivotal role in facilitating financial transactions. Each Reserve Bank acts as a clearinghouse for banks within its designated region. This means they handle the exchange of funds between banks, both within their region and nationwide. This network ensures the efficient movement of money across the country, fostering a stable and functional financial system.

Federal Reserve Banks are assigned unique routing numbers that identify their respective regions. These numbers are crucial for electronic transactions and wire transfers. When banks need to transfer funds to another institution, they use these unique routing numbers to direct the funds to the appropriate Federal Reserve Bank. The Reserve Bank then acts as an intermediary, moving the funds between the involved banks and ensuring a seamless transaction.

Finding the Routing Number for Federal Reserve Banks

While most individuals may not need to directly interact with Federal Reserve Banks for their daily banking needs, understanding their routing numbers is vital for specific financial operations. For instance, businesses often use wire transfers to facilitate large transactions, and financial institutions might use these numbers for internal settlements.

Fortunately, acquiring this information is straightforward. The Federal Reserve’s official website provides a comprehensive list of routing numbers for all its regional banks. You can easily find the specific routing number for each Federal Reserve Bank by navigating to their website and accessing the “Routing Numbers” section. Alternatively, you can consult a reputable directory of bank routing numbers available online or contact the Federal Reserve directly for assistance.

Image: myfin.us

A List of Routing Numbers for Federal Reserve Banks

Here’s a general overview of Federal Reserve Bank routing numbers, along with the regions they serve:

| Federal Reserve Bank | City | Routing Number |

|---|---|---|

| Federal Reserve Bank of Boston | Boston, MA | 011000021 |

| Federal Reserve Bank of New York | New York, NY | 021000021 |

| Federal Reserve Bank of Philadelphia | Philadelphia, PA | 031000021 |

| Federal Reserve Bank of Cleveland | Cleveland, OH | 041000021 |

| Federal Reserve Bank of Richmond | Richmond, VA | 051000021 |

| Federal Reserve Bank of Atlanta | Atlanta, GA | 061000021 |

| Federal Reserve Bank of Chicago | Chicago, IL | 071000021 |

| Federal Reserve Bank of St. Louis | St. Louis, MO | 081000021 |

| Federal Reserve Bank of Minneapolis | Minneapolis, MN | 091000021 |

| Federal Reserve Bank of Kansas City | Kansas City, MO | 101000021 |

| Federal Reserve Bank of Dallas | Dallas, TX | 111000021 |

| Federal Reserve Bank of San Francisco | San Francisco, CA | 121000021 |

Tips and Expert Advice: Utilizing Routing Numbers Effectively

While understanding the basics of routing numbers is essential for financial literacy, there are a few key areas where you can apply these skills to your advantage. Here are some tips for utilizing routing numbers effectively:

- Double-check routing numbers before any transaction: Always verify the routing number provided for any payment, transfer, or deposit. Inaccurate routing numbers can lead to delays, lost funds, and potential fraud.

- Stay abreast of routing number changes: Keep an eye on updates from your bank or financial institution regarding any changes in routing numbers. Mergers, acquisitions, and other institutional adjustments can result in updated routing codes.

- Utilize online resources for accurate information: The Federal Reserve website, alongside reputable online directories, offers reliable and readily available information about routing numbers.

Frequently Asked Questions (FAQs)

Q1: What are routing numbers used for?

Routing numbers are used to identify and direct financial transactions between banks. When you deposit a check, transfer funds, or pay a bill electronically, your bank’s routing number tells the receiving bank’s network where to send the money. It ensures accurate and efficient processing of transactions.

Q2: How do routing numbers work?

Routing numbers are nine-digit codes that act as postal addresses for your money. When you initiate a transaction, your bank’s routing number is used to direct the funds to the receiving bank’s network. This network then routes the funds to the appropriate recipient based on the account information provided.

Q3: Where can I find the routing number for my bank?

You can usually find your bank’s routing number on your checks, bank statements, or on your bank’s website. You can also contact your bank directly to obtain this information.

Q4: Are routing numbers the same for all branches of a bank?

Yes, a bank’s routing number is the same for all its branches across the country. This ensures a consistent identifier for the financial institution, regardless of its physical location.

Q5: What happens if I use the wrong routing number?

Using the wrong routing number can lead to a delay in processing your transaction, as the funds will be sent to the incorrect recipient. In some cases, the funds may be returned to the sender, while in other cases, they may be lost altogether.

List Of Routing Numbers For Federal Reserve Banks

https://youtube.com/watch?v=ev2LePKNHHs

Conclusion

Routing numbers are an integral part of the American financial system, quietly working behind the scenes to ensure smooth and efficient transactions. Understanding their function and the roles of Federal Reserve Banks helps you navigate a complex yet interconnected financial landscape. Whether you are a consumer, business owner, or financial professional, a deeper grasp of routing numbers can empower you to make informed decisions and navigate the financial world with greater confidence. Are you interested in learning more about the financial system, or perhaps exploring other aspects of banking?