Imagine this: you’re finally ready to buy a house, but your credit score is holding you back. You’ve been diligent with payments, so what’s the issue? A surprise medical bill, long forgotten, is dragging your score down. This scenario, unfortunately, is all too common. Medical debt can significantly impact your credit score, making it challenging to access loans, secure housing, or even land a job. The good news is, there are ways to address this. This guide will help you understand how to remove medical bills from your credit report, providing a simple “template” you can follow.

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)

Image: fabalabse.com

Removing medical bills from your credit report is a process that requires understanding the intricacies of credit reporting and navigating the legal complexities. It’s important to note that there are various factors that influence the success of this process, and it might not always be a quick fix. This guide aims to equip you with the knowledge and resources to approach this situation strategically and effectively.

Understanding the Process: Medical Bills and Your Credit Report

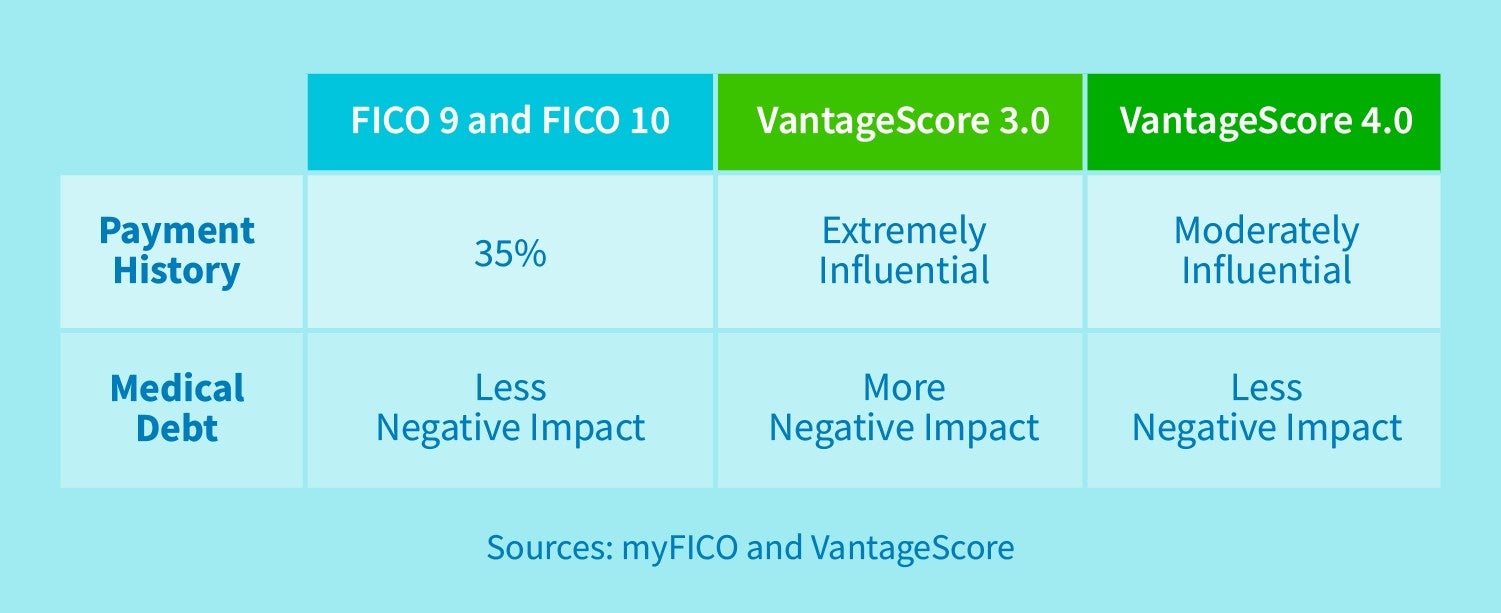

Medical bills impacting your credit score usually stem from unpaid medical expenses. When providers cannot collect on the debt, they often report it to credit bureaus like Equifax, Experian, and TransUnion. These reports become part of your credit history, influencing your overall credit score. It’s crucial to understand the process of disputing these entries and how to remove them.

The first step involves identifying the specific medical bills being reported to the credit bureaus. You can access your credit report through annualcreditreport.com, a free service provided by the three major credit bureaus. Carefully examine each report for any medical bills you don’t recognize or that you believe are inaccurate. This is often the starting point for the dispute process.

The Template: A Step-by-Step Guide to Dispute Medical Bills

1. Gather Your Documentation

Begin by consolidating all relevant documents. This includes:

- Copies of your credit reports from all three bureaus

- Any medical bills or statements you have

- Correspondence related to the disputed medical bills

- Medical records, if necessary, to verify your treatment

Image: www.creditrepair.com

2. Initiate the Dispute

Once you’ve gathered all necessary documents, you can start the dispute process. You can dispute inaccuracies online, by mail, or by phone with each credit bureau. Use the dispute form on the bureau’s website. Ensure you clearly state the specific inaccuracies or issues you’re disputing, provide supporting documentation, and request a correction.

When disputing, explicitly state your reason:

- The balance is incorrect: Did you mistakenly receive a bill or was the service not rendered?

- The account is not yours: Was the medical bill intended for someone else with a similar name?

- The account is closed or paid in full: Have you made full payment for the medical services but it is still showing unpaid in the report?

- The bill received was not from a medical provider: Check if the debt was reported to the credit bureaus by a collection agency, which may not be accurate.

3. Follow Up

After initiating the dispute, stay persistent and follow up. Credit bureaus typically have 30 days (or 45 days for mail) to investigate and respond. If you don’t hear anything, contact them again. This proactive approach often helps expedite the resolution process.

4. Negotiate with the Provider

If the dispute with the credit bureau proves unsuccessful, consider negotiating directly with the medical provider. This can be challenging but often yields positive outcomes. The goal is to find a resolution, which can involve:

- Payment Plan: Setting up a payment plan to clear the outstanding balance.

- Debt Settlement: Agreeing on a lower settlement amount to settle the debt.

- Financial Assistance: Exploring options like financial assistance or charity care programs offered by the provider.

Expert Advice on Navigating the Dispute Process

Here are key tips to remember:

- Be Persistent: The credit bureau dispute resolution process can be tedious. Don’t give up easily. Keep records of all communications and follow up regularly.

- Collaborate with the Provider: Before disputing with a credit bureau, consider contacting the medical provider directly. Negotiating a resolution with the provider can often be a quicker and more effective approach.

- Consult a Credit Counselor: If you’re struggling with debt and the dispute process seems overwhelming, consider consulting a reputable credit counselor. A counselor can guide you through the process and offer practical advice on financial management.

- Consider Legal Counsel: If the debt is significantly impacting your life or if you believe the debt is illegal, consult an attorney specialized in consumer debt or credit reporting. Legal guidance can be invaluable in navigating complex dispute situations.

Common Questions about Medical Bills and Credit Reports

Q: What if I can’t afford to pay my medical bills?

A: If you’re facing financial hardship, it’s crucial to connect with the medical provider. Many hospitals and healthcare providers have financial assistance programs or charity care options for patients who demonstrate financial need. They can help you access affordable or even free care that can alleviate the strain on your credit report.

Q: Can I remove medical debt from my credit report after a certain amount of time?

A: The statute of limitations for debt collection varies by state. After this time, the debt is considered “time-barred,” meaning the creditor cannot take legal action to collect. However, even if the debt is time-barred, it may still appear on your credit report. It’s vital to contact the credit bureaus to ensure the outdated information is removed.

Q: What if the medical debt is inaccurate?

A: If you believe the medical debt reported is incorrect, it’s crucial to dispute it. The credit bureaus have a legal obligation to investigate your claim and make any necessary corrections. Involve the medical provider in the dispute process to resolve any discrepancies.

Template To Remove Medical Bills From Credit Report

Call to Action: Take Control of Your Credit

Understanding how to remove medical bills from your credit report empowers you to take control of your financial future. This process, while sometimes challenging, can be successful with persistence, proper documentation, and the right approach.

Are you facing challenges with medical debt impacting your credit score? Share your experiences and questions in the comments below. Let’s work together to navigate this complex issue and improve our credit health.