Ever felt overwhelmed by a jumbled mess of receipts, handwritten notes, and spreadsheets? Struggling to keep track of your business’s cash flow? You’re not alone. Many individuals and small businesses grapple with the challenge of managing cash transactions effectively. But what if there was a simple, organized solution that could streamline your finances and give you a clear picture of your cash position? That’s where a cash book template comes in.

Image: www.excel-template.net

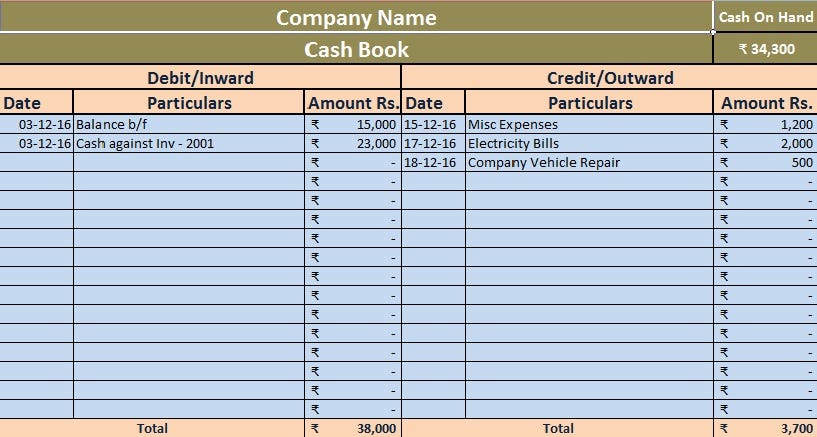

A cash book template, which you can easily download in PDF format, is essentially a digital or printable record of all your cash inflows (money received) and outflows (money spent). It’s a fundamental tool that provides a structured and systematic way to monitor your financial activity, making it easier to analyze your financial health, budget effectively, and make informed decisions about your business or personal finances. In this article, we’ll delve into the benefits of using a cash book template, the diverse types available, and how to choose the perfect template for your specific needs.

Why Use a Cash Book Template?

Before diving into the specifics, let’s understand why a cash book template is a valuable asset, especially for small businesses and individuals looking to improve their financial organization:

- Simplified Financial Tracking: The template provides a clear framework for recording all your financial transactions, making it effortless to see where your money is coming from and going to. Say goodbye to scattered notes and lost receipts!

- Enhanced Budgeting and Planning: By tracking your cash inflows and outflows, you gain valuable insights into your spending patterns and can make better budget decisions. Whether it’s saving for a specific goal or identifying areas for cost reduction, a cash book provides the clarity you need.

- Improved Financial Visibility: With a comprehensive cash book, you always have a bird’s-eye view of your financial position. This allows you to identify potential issues or opportunities early on, enabling you to take proactive steps to manage your finances effectively.

- Streamlined Reconciliation: Reconciling your cash book with your bank statements becomes an easier task. By meticulously recording every transaction, you can accurately match your records with bank statements and ensure there are no discrepancies.

- Tax Preparation Made Easier: A well-maintained cash book serves as a valuable document for tax preparation. You can easily provide accurate information to your accountant or tax authorities when required, minimizing potential complications.

Types of Cash Book Templates

Cash book templates come in various formats to suit different needs and preferences. Let’s explore some popular types:

1. Simple Cash Book Template

Ideal for individuals and small businesses with basic financial needs, this template typically includes columns for:

- Date

- Description of transaction

- Cash inflow (debit)

- Cash outflow (credit)

- Balance

Its simplicity makes it easy to understand and maintain, even for those with limited accounting experience.

Image: medium.com

2. Double-Entry Cash Book Template

This template adheres to the double-entry accounting system, involving recording every transaction in two separate accounts (debit and credit). This method provides a higher level of accuracy and provides a detailed picture of your financial activity. It’s often used by businesses with more complex financial operations.

3. Business Cash Book Template

Designed specifically for businesses, this template includes additional columns to cater to business-specific expenses, such as inventory purchases, sales revenue, and accounts payable. It provides a detailed view of the business’s cash flow and financial performance.

4. Personal Cash Book Template

Tailored for individuals, this template helps track personal income, expenses, and savings. Columns may include categories for income sources, regular expenses, discretionary spending, and savings goals.

Choosing the Right Cash Book Template

To select the perfect cash book template for your needs, consider these factors:

- Your Financial Needs: Do you need a simple template for basic tracking or a more advanced one for detailed financial analysis?

- Your Accounting System: Are you using single-entry or double-entry accounting? Choose a template that aligns with your accounting methods.

- Your Industry: Select a template that caters to the specific expenses and revenue streams relevant to your industry.

- Your Technological Preferences: Do you prefer a digital template or a printable one? Consider your preferred method of using the template.

- Your Level of Financial Knowledge: If you’re new to accounting, a simpler template with clear instructions might be more suitable.

Tips for Using a Cash Book Template Effectively:

To maximize the benefits of using a cash book template, keep these tips in mind:

- Be Consistent: Make a habit of recording every transaction promptly and accurately. This ensures a consistent and reliable record of your financial activity.

- Use Clear and Descriptive Language: Provide detailed descriptions of your transactions, making it easier to recall the purpose and context later.

- Organize Your Receipts: Store your receipts and supporting documents in a designated folder or system that’s easily accessible for reference.

- Reconcile Regularly: Compare your cash book with your bank statements on a regular basis (weekly or monthly). This helps identify any discrepancies and ensure the accuracy of your records.

- Review and Analyze: Regularly review your cash book to gain insights into your spending patterns, identify areas for improvement, and make informed financial decisions.

Where to Find Free Cash Book Templates

There are numerous websites and resources offering free cash book templates in PDF format. Here are some places to start your search:

- Online Templates Libraries: Websites like Template.net, Canva, and Microsoft Office offer a diverse range of free cash book templates.

- Accounting Software Providers: Software providers like FreshBooks, QuickBooks, and Xero often provide free downloadable cash book templates that integrate with their platforms.

- Financial Websites: Websites focusing on finance and accounting, such as Investopedia and AccountingTools, often offer free cash book templates.

Cash Book Template Free Download Pdf

Conclusion:

A cash book template is an invaluable tool for anyone seeking to achieve greater financial control and organization. By utilizing a free downloadable PDF template, you can simplify financial tracking, enhance budgeting, gain valuable financial insights, and ultimately improve your financial decision-making. Take advantage of the many readily available resources and find the perfect template to empower your financial journey! Remember, a well-maintained cash book is your key to unlocking financial clarity and success.