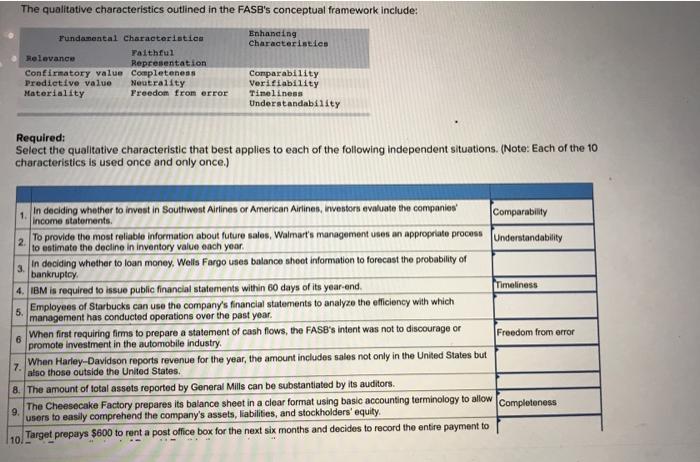

Imagine you’re trying to navigate a complex maze without a map. It’s overwhelming, frustrating, and you’re likely to end up lost. Applying the right information is crucial to success, and that’s where the conceptual framework’s qualitative characteristic of relevance comes into play. In accounting and finance, it acts as a guide, ensuring that the information you use is not just accurate, but directly pertinent to your specific needs and goals.

Image: www.chegg.com

This article delves into the world of relevance, a critical pillar for effective decision-making. We’ll explore its intricate mechanisms, understand its practical applications, and discover how it empowers you to navigate complex information landscapes with confidence.

Understanding the Essence of Relevance

Relevance, within the context of a conceptual framework, is more than just “being related”. It’s about information having the ability to impact decision-making. Imagine a company’s financial statements outlining its profitability and liquidity. For an investor deciding whether to invest, this information is highly relevant. However, if that same information is presented to someone unfamiliar with financial analysis, it may be irrelevant, lacking the power to influence their decision.

The Conceptual Framework provides a framework to ensure that information:

- Influences choices: Relevant information helps users make informed decisions about resource allocation, forecasting, and performance evaluation.

- Predicts future outcomes: Relevant information sheds light on potential consequences, allowing users to anticipate and plan for future scenarios.

- Confirms prior expectations: It helps users verify or adjust their existing assumptions about the entity’s performance and financial position.

The Many Faces of Relevance: Key Principles

Relevance is not a singular concept; it’s a multifaceted characteristic that operates through several key principles:

1. Materiality: This principle acknowledges that not all information is equally important. Materiality emphasizes that information is relevant only if its omission or misstatement could influence the decisions made by users. A small change in accounts receivable might not be material for a large corporation, but it could be crucial for a small startup.

2. Predictive Value: Relevant information helps users anticipate future outcomes. For instance, analyzing historical sales data can help predict future demand and support strategic planning.

3. Confirmatory Value: This principle ensures that information confirms or challenges users’ existing expectations. For example, a company’s earnings report can confirm or contradict analysts’ predictions, shedding light on its financial performance and future prospects.

4. Timeliness: Relevance is also influenced by timeliness. Information presented too late loses its value. Timely financial reports allow investors to make informed decisions about their investments before market conditions change significantly.

Beyond Theory: Putting Relevance into Practice

Relevance is not just a theoretical concept; it has practical implications for decision-making in various fields, including:

1. Business and Finance:

For investors, relevant information helps determine the potential risks and rewards of investing in a particular company, providing insights into its financial health, growth prospects, and management strategies.

2. Accounting and Auditing:

Accountants and auditors use relevance to ensure that financial statements provide a fair and accurate representation of an organization’s financial position. They prioritize information that helps users understand the entity’s economic performance and capitalize on its strengths.

3. Government and Policy:

Relevant information is vital for policymakers to make informed decisions about resource allocation, tax policies, and social programs. By considering relevant economic and social indicators, policymakers can develop effective strategies for addressing social challenges and promoting economic well-being.

Image: www.researchgate.net

Experts Advise: Navigating the Relevance Maze

Navigating the often complex world of information requires guidance. Here are some invaluable insights from leading experts:

-

Focus on the user’s needs: Always consider the specific needs and objectives of the intended users. For example, information relevant to an investor might be quite different from information relevant to a creditor.

-

Embrace critical thinking: Assess the credibility of the information source and carefully analyze its potential influences on your decisions.

-

Embrace continuous learning: Stay informed about the latest trends and developments in your field to ensure you’re using the most relevant information.

The Conceptual Framework’S Qualitative Characteristic Of Relevance Includes

Conclusion: Making Information Matter

Relevance is the cornerstone of effective decision-making. By understanding and applying the conceptual framework’s qualitative characteristics of relevance, you can ensure that the information you use is not just accurate but also meaningful and impactful. As you navigate the ever-growing landscape of data, remember that relevance is a powerful tool that can help you make informed choices, navigate complex situations, and ultimately achieve your goals. Embrace the concept of relevance, and empower your decision-making with clarity, confidence, and the ability to make information truly matter.