Have you ever looked at your pay stub and felt a wave of confusion wash over you? Those seemingly endless rows of numbers and deductions can be a real head-scratcher, leaving you wondering how your hard-earned money gets divvied up. Well, fret no more! This comprehensive guide will walk you through the intricacies of your pay stub, making those numbers as clear as day (and hopefully, a little less frustrating). In this chapter, we’ll be focusing on Lesson 2: Understanding Key Deductions and Earnings. So buckle up, because we’re about to embark on a journey into the fascinating world of your paycheck.

Image: chessmuseum.org

Understanding your pay stub isn’t just about knowing how much you’re taking home. It’s about understanding the components that make up your overall earnings, the taxes and deductions that impact your net pay, and ultimately, how your income is being managed. This knowledge equips you to make informed financial decisions, plan for the future, and even spot potential errors on your pay stub, ensuring you’re getting paid what you deserve.

Deciphering the Pay Stub: A Breakdown

1. Earnings: The Big Picture

Your pay stub usually starts with a clear breakdown of your earnings—the money you’ve generated before any deductions. Some pay stubs may even show how those earnings were calculated, which can be incredibly helpful for understanding how your pay is structured. Let’s unpack some common components:

- Regular Pay: This is your standard hourly or salary pay, reflecting the hours you’ve worked or the agreed-upon salary for the period.

- Overtime Pay: If you’ve worked beyond your regular hours, this section displays your overtime earnings, typically calculated at a higher rate than regular pay.

- Bonuses: This is where any special bonuses or incentive payments will appear.

- Commissions: For sales-based positions, this section showcases earnings from commissions based on your sales performance.

2. Deductions: The Nitty-Gritty

The deductions section is where the magic of your net pay happens, or perhaps more accurately, where the magic disappears. This is where all the taxes and other contributions are subtracted from your gross earnings. It’s a bit like a tax-and-contribution buffet, with a variety of options presented.

- Federal Income Tax: This is the largest deduction for most people, contributing to the federal government’s coffers and partially funding essential services.

- State Income Tax: Depending on your state of residence, you might see a deduction for state income tax, which supports state-specific initiatives.

- Social Security: Also known as FICA (Federal Insurance Contributions Act), this deduction contributes to the social security system, providing benefits for retirement, disability, and survivors.

- Medicare: Medicare is another FICA deduction, supporting the healthcare system for those over 65 and individuals with certain disabilities.

- Health Insurance: If you have insurance through your employer, this deduction covers your portion of the premium.

- Dental Insurance: Similar to health insurance, this deduction covers your dental insurance premium.

- Vision Insurance: This deduction helps cover the cost of vision care, such as eye exams and glasses or contact lenses.

- Retirement Contributions: If you’ve opted into a retirement plan offered by your employer, this deduction reflects your contributions, which are invested for your future financial security.

- Union Dues: If you belong to a labor union, this deduction covers your membership dues.

Image: www.uslegalforms.com

3. Other Important Details

Beyond the earnings and deductions, your pay stub usually contains other crucial information:

- Pay Period: This clearly shows the period covered by the pay stub, typically weekly, bi-weekly, semi-monthly, or monthly.

- Gross Earnings: This is your total earnings before any deductions.

- Net Pay (Take-Home Pay): This is the amount you actually receive after all taxes and deductions have been taken out.

- Year-to-Date (YTD): This section shows the total earnings and deductions for the current year, providing a broader financial picture.

- Employee Information: This includes vital details such as your name, employee ID number, and contact information.

4. The Power of Pay Stub Comparisons

One of the best ways to get a grasp on your finances is to compare your pay stubs over time. This lets you see any fluctuations in your earnings, deductions, or net pay. You might notice changes due to promotions, raises, bonuses, or even errors. Moreover, comparing your pay stubs across different periods can be helpful for:

- Budgeting: Track your income and expenses to see how your spending aligns with your earning potential.

- Tax Planning: Identify any year-to-date discrepancies, so you can adjust your tax withholding or plan for potential tax liabilities.

- Financial Goals: Monitor your progress in saving for specific goals like buying a house, paying off debt, or investing for retirement.

- Identifying Errors: Be vigilant about potential discrepancies or mistakes, and contact your employer immediately if you spot anything unusual.

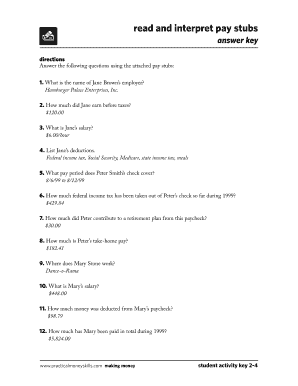

Reading A Pay Stub Chapter 10 Lesson 2 Answer Key

The Bottom Line: Your Pay Stub, Your Financial Ally

By understanding the various components of your pay stub, you gain a powerful tool for managing your finances. It becomes a valuable window into your earnings, deductions, and income trends. Take the time to decipher your pay stub, use it to track your financial progress, and don’t hesitate to contact your employer or HR department if you have any questions or encounter any discrepancies. Armed with this knowledge, you can navigate the world of paychecks with confidence and make informed financial choices for your future.