Imagine this: it’s tax season, and you’re staring at a mountain of paperwork, your heart pounding with a mix of dread and confusion. You know you need to file your taxes, but the process feels overwhelming, like deciphering hieroglyphics. This is a common experience, and it’s where Chapter 10 Lesson 4, a crucial stepping stone in understanding the US tax system, comes in. Let’s dive into this lesson and equip you with the knowledge to navigate tax season with confidence.

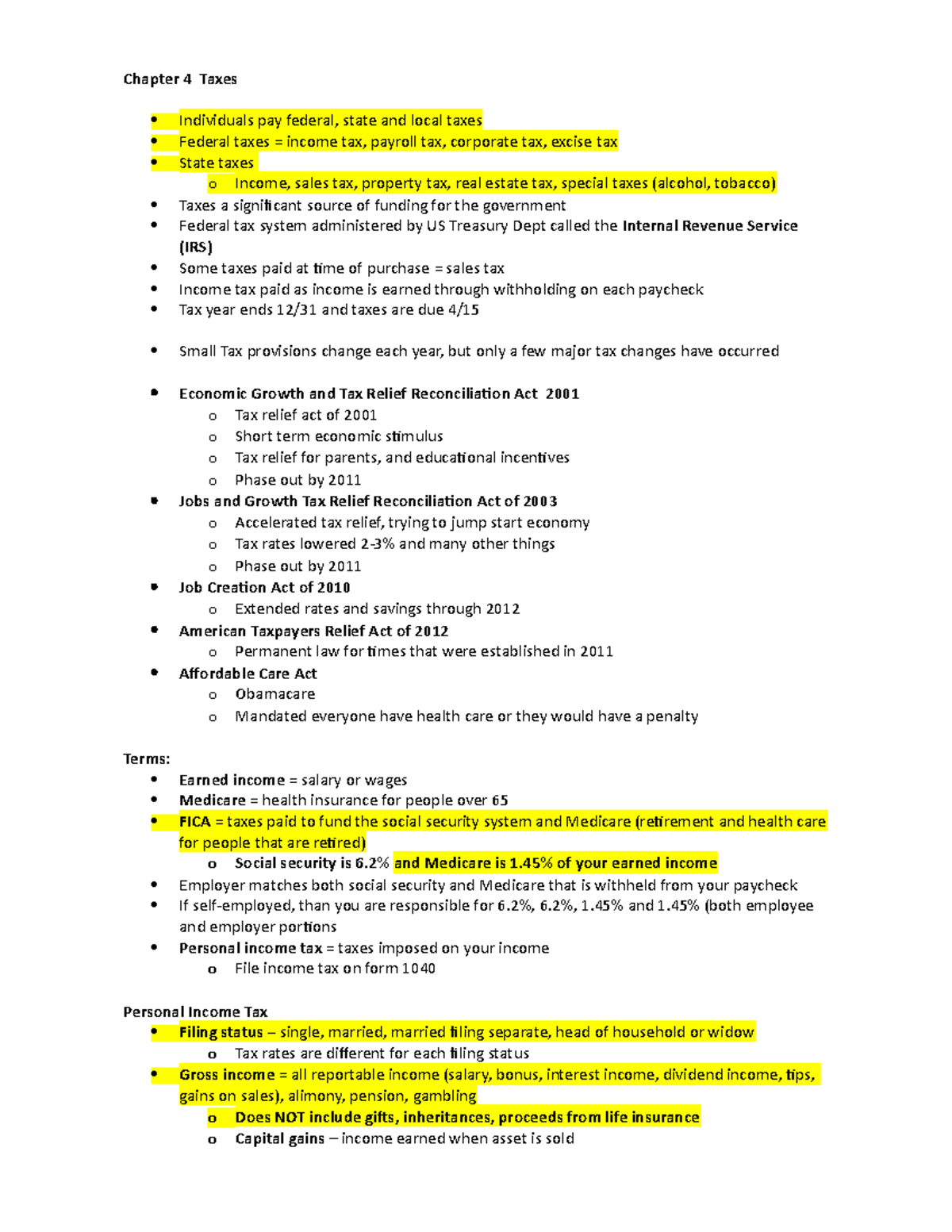

Image: www.studocu.com

This lesson, often tackled in high school and introductory economics courses, lays the groundwork for understanding various aspects of taxation, particularly income tax, its impact on individuals and businesses, and ultimately, how it contributes to the functioning of our nation. Understanding the concepts within this chapter is key to navigating the complexities of tax season, understanding your tax obligations, and ultimately, maximizing your financial potential.

Delving into the Core Concepts of Chapter 10 Lesson 4

Chapter 10 Lesson 4 typically focuses on the fundamental principles of income tax, the backbone of the US tax system. Let’s break down the key elements:

1. The Concept of Income Tax

- Definition: Income tax is a levy imposed on individuals and businesses based on their earnings. Think of it as a percentage of your paycheck that goes towards funding essential government services like education, healthcare, infrastructure, and national defense.

- Progressive Nature: The US income tax system is progressive, meaning higher earners pay a larger percentage of their income in taxes. This is designed to ensure fairness and promote social equity.

2. Understanding Taxable Income

- What Counts: Taxable income encompasses various sources of earnings, including wages, salaries, self-employment income, investments, and capital gains.

- What Doesn’t Count: There are deductions and exemptions that can reduce your taxable income, leading to lower taxes. Common examples include mortgage interest, charitable contributions, and standard deductions.

3. The Role of Withholding:

- Payroll Deductions: Throughout the year, employers withhold taxes from your salary. This is a form of “prepayment” towards your tax obligations.

- Balancing Act: This system aims to ensure that individuals don’t face a giant tax bill at the end of the year, and it avoids the burden of paying a lump sum.

4. The Tax Filing Process

- Annual Obligations: Come tax season, individuals must file a tax return, providing a detailed account of their income and deductions.

- Types of Forms: Various tax forms exist, such as Form 1040, to capture your financial data. Fortunately, numerous resources, like IRS publications and free tax preparation software, can guide you through the process.

5. The Impact of Tax Policy on Individuals and Businesses

- Economic Influence: Tax policies can significantly influence economic activity, impacting consumer spending, investment decisions, and overall economic growth.

- Government Funding: Tax revenue is the lifeblood of the government, funding vital services that benefit all citizens.

Navigating Tax Season like a Pro

Now, armed with a deeper understanding of the core concepts within Chapter 10 Lesson 4, let’s empower you to navigate tax season with confidence.

Expert Tip #1: Get Organized Early

- Gather all relevant documents, such as pay stubs, investment statements, and receipts. This will help you ensure accuracy and avoid last-minute stress.

Expert Tip #2: Take Advantage of Free Resources

- Explore free tax preparation software, available from organizations like the IRS and reputable online platforms. These tools can simplify the process.

Expert Tip #3: Don’t Be Afraid to Seek Professional Help

- If your tax situation is intricate, consider consulting a tax professional. Tax accountants can provide personalized guidance and ensure you take advantage of all available deductions and credits.

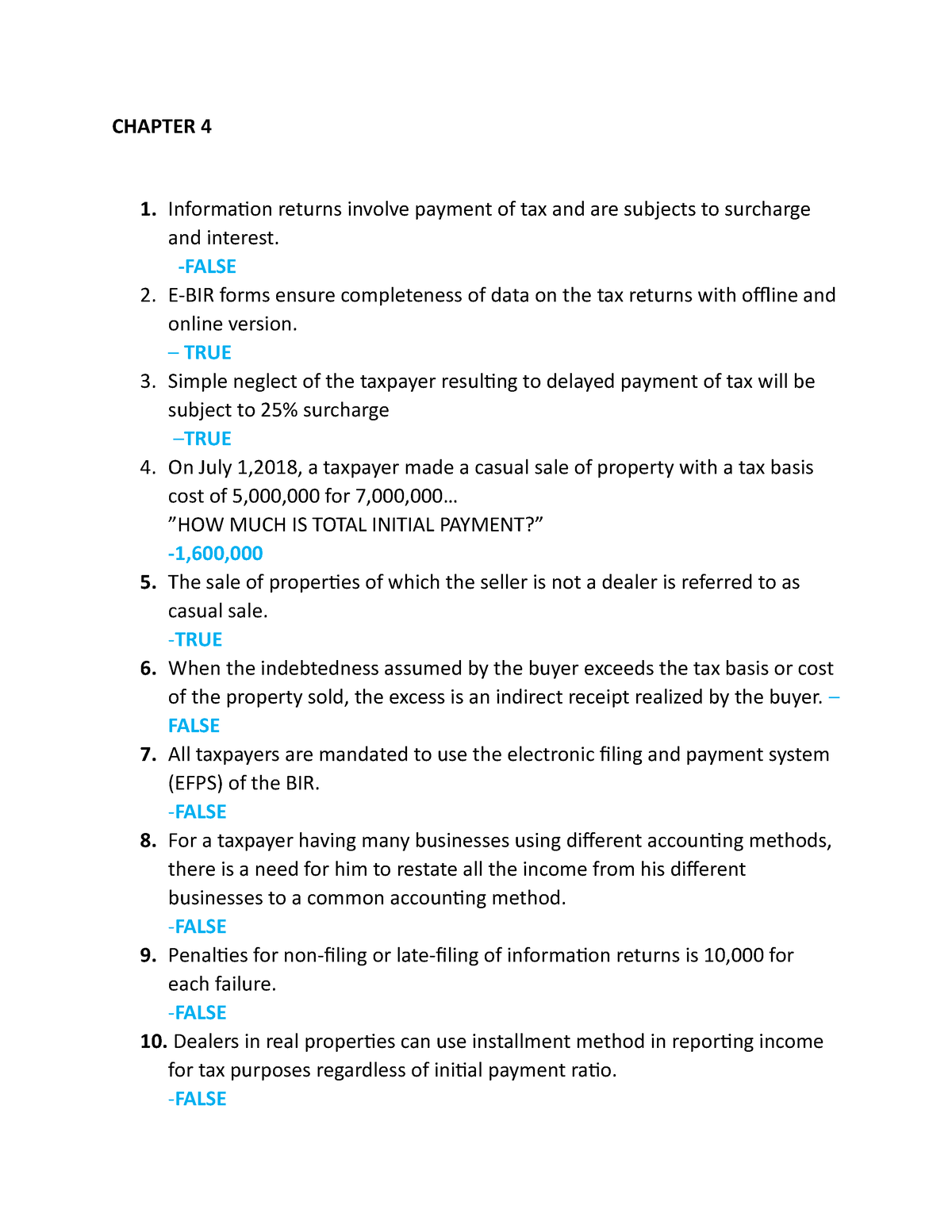

Image: www.studocu.com

Filing Your Taxes Chapter 10 Lesson 4 Answer Key

Conquering Tax Season with Confidence

By embracing the fundamentals of Chapter 10 Lesson 4, you can approach tax season with a newfound understanding and preparedness. Remember, understanding your tax obligations is crucial to maximizing your financial well-being. Don’t let the complexities of tax season overwhelm you; leverage this knowledge to confidently manage your finances and secure your financial future. Start today, delve deeper into this essential knowledge, and be empowered to navigate the world of taxes with ease.